What Credit Score Do I Need for an Auto Loan?

As an adult, you have a credit report that summarizes how you've handled your credit accounts which are reviewed and scored. Think of it as your credit report is your new report card, and your credit score is your new GPA. A negative inquiry or delinquency on your report can drastically lower your credit score. This can take time to restore which you might think will ultimately put a hold on many parts of your life, like financing a car.

If your fear is getting denied a loan because of bad credit, here's an answer:

You don't need a specific credit score to be approved for a loan at Skyla Credit Union |

How? Because we review more than just your credit score, we review multiple factors, including your employment, income, and other financial assets. And we've been doing this for more than 50 years.

I'm your friend and financial expert here at Skyla ready to give you the tools and tips you need to help you reach credit score success and get the auto loan you need to buy your new car. I'll share everything about credit scoring, including how your credit score is calculated, what to expect with a low-interest or high-interest rate, and more. Plus, there's a freebie for you to help with your credit report and scoring!

Ready to dive in?

understanding your credit score

understanding your credit score

WHAT IS A CREDIT SCORE?

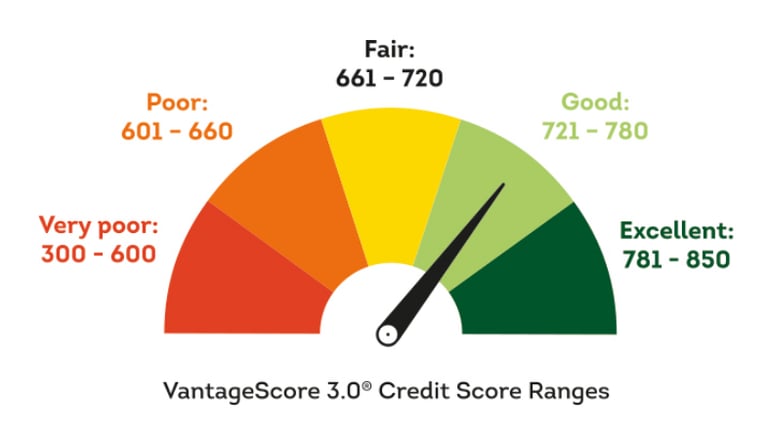

It’s a three-digit number ranging from 300-850 based on a credit report, which is information formulated by three reporting credit bureaus or agencies - TransUnion, Experian, and Equifax. The credit score determines your borrowing power or level of receiving a loan. The credit agencies use different credit scoring systems to determine your score. The most common credit-scoring systems used is VantageScore and Fair Isaac Corporation (FICO).

Here's a look at the credit score ranges from the VantageScore 3.0 model.

HOW IS MY CREDIT SCORE CALCULATED?

Your credit score is measured by multiple factors. Here’s a look at how your score is calculated using VantageScore:

- Payment History: This includes your account payment information, including any delinquencies and public records.

- Age & Credit Mix: This reflects the variety and age of your credit accounts. Lenders like to see a mix of credit types and well-aged accounts.

- Utilization: This measures the percentage of available credit you're using. To achieve the best score in this category, aim to keep your utilization rate low.

- Balances: This looks at the total amount of debt you owe across all your accounts. Although it's less heavily weighted, maintaining low balances is still important as it makes up 5% of your score.

- New Credit: This tracks new credit applications you've made. Limiting the number of new credit inquiries can help maintain your score.

- Available Credit: This examines the total credit limit you have available. Higher available credit can be beneficial.

QUICK TIP: Did you know that credit bureaus like Experian, Equifax, and TransUnion don't actually create your credit score? They maintain your credit file, while scoring systems like VantageScore and FICO calculate your three-digit score. At Skyla, we use the VantageScore model, developed by these bureaus, to fairly evaluate your financial responsibility and potential ability to repay loans. |

what credit score do i need for an auto loan?

what credit score do i need for an auto loan?

Honestly, there isn’t one specific credit score needed to receive an auto loan. But, the higher your credit score, the better chance you’ll have at receiving a low-interest rate. Why? Because lenders need to know you can be reliable when it’s time to repay the loan.

what interest rate can i get with my credit score?

what interest rate can i get with my credit score?

If your credit score is in the high 700’s, you can expect a lower interest rate which gives you more buying power (meaning you can receive a higher loan amount). A borrower can expect a higher interest rate with a low credit score below 600.

In the example below, check out Member A and B’s buying power when they receive their auto loan based on their credit score with a loan term of 60 months.

More Buying Power

*Rates are for demonstrative purposes only.

Notice how both members make about the same car payment; however, Member B can afford a higher loan amount with a low-interest rate because of B’s 719 credit score. Keep in mind that the higher your credit score the better interest rate you'll receive on a loan. Psst… Want to calculate your own interest rate? Simply check out the blog article for How Is My Interest Rate on an Auto Loan Calculated.

how does my auto loan affect my credit score?

how does my auto loan affect my credit score?

Long term, taking out an auto loan can positively impact your credit score. When you first apply for your loan, lenders run a hard credit inquiry to check your credit report. A hard inquiry or a hard credit pull lowers your score by a few points. (But don’t worry, a single hard inquiry disappears and drops off your credit report after a few weeks.)

QUICK TIP: Avoid applying for multiple lines of credit at the same time or even in the span of a few months. Why? Lenders will consider you to be a risk when determining your eligibility for an auto loan. |

Maintaining on-time payments on your auto loan for a period of time helps increase your credit score. Simply missing a payment can negatively impact your credit score. You can establish a credit score from your loan with a payment history of six months plus the activity reported in the last six months.

HERE’S WHAT I MEAN…

Let’s say you receive a $10,000 credit card from your preferred lender. You actively use the credit card for different expenses and make on-time payments. Your lender later reports each payment made towards the credit card to the credit reporting bureaus (Equifax, Transunion, Experian). That activity reflects on your credit report which helps you establish a credit score.

how to clean up and improve my credit score?

how to clean up and improve my credit score?

Companies like Credit Repair and Experian offer credit repairing services with a possible fee where they do the work for you to boost and improve your credit score. If you want to do this for free, you can start with the following:

- Get your full credit report to view your reporting history and remove any inaccurate inquiries. Legally, you can retrieve your full credit report for free every 12 months from Annual Credit Report.com

- Pay off or pay down your credit cards to lower the balance and overall credit usage

- Don’t close your cards since it may decrease your average length of credit. Have you had a bad experience with a credit card? If you want to avoid going down the same road or paying an annual fee, closing the card may be the better option for your situation.

- Make on-time payments whenever possible for all of your loans.

- Slow down and don't open too many new lending accounts too quickly to give your credit time to rebuild.

When fixing your credit, don't feel like it's something beyond your control. It’s very much within your control. It may not be instantaneous, but having a good credit score is absolutely achievable, and we're happy to help!

- Susan Espinosa, VP Member Experience at Skyla Credit Union

Want to know more about your credit score and learn how to avoid common pitfalls? Click below!

here's what to remember with credit scoring and auto loans:

here's what to remember with credit scoring and auto loans:

Remember, there is more to just the credit score that is factored in when determining a loan. There isn't a specific credit score needed, but the level of interest rates depends on how high or low your credit score is. The higher the credit score, the lower the interest rate. Want to calculate your own interest rate? Check out the blog post How Is My Interest Rate Calculated to learn how.

One last thing...

When working to improve your credit score, know that it takes time and doesn't happen overnight. So be patient and understand that a good credit score is achievable. At Skyla, we can help you achieve those goals. To get started, send us an email or give us a call at 704.375.0183.

ready for your freebie?

Ready to reach your credit score goals? Download the free Credit Score Guide to get started.

As Content Strategist behind the Learning & Guidance Center, Yanna loves showing just how doable finance can be. Whether it’s simple tips, step-by-step guides, or comparison charts, she’s passionate about helping readers take charge and reach financial freedom with confidence

more resources to get you ready to roll

What's the Most Important Thing to Understand About Credit Scores?

Need help understanding your credit score? Here’s what’s most important about credit scoring and the steps to take to improve it.

9 min. read

Should You Consider a Down Payment On Your Auto Loan?

Can a down payment really help you with your auto loan? This article will show you why you should consider a down payment, what’s an acceptable down payment, and …

9 min. read

figure out what credit score is needed

figure out what credit score is needed

Find out the score you need, how your credit score is calculated, and more.

budget for an auto loan

budget for an auto loan

Don’t know your options when budgeting for an auto loan? Determine if monthly payments or making a full payment up-front is the best way to go.

determine if you need to do a down payment

determine if you need to do a down payment

Can a down payment really help you with your auto loan? Here's why you should consider a down payment, what’s an acceptable down payment, and more.