What is Buy Now, Pay Later?

Ever wanted to buy that must-have item or experience—like a concert ticket, a weekend getaway, or even a new phone—without immediately feeling the pinch on your wallet?

Ever wanted to buy that must-have item or experience—like a concert ticket, a weekend getaway, or even a new phone—without immediately feeling the pinch on your wallet?

Buy Now, Pay Later (BNPL) might seem like the perfect solution. It allows you to make purchases and spread the payments over time, which can help ease that upfront cost. But before you dive in, let's explore what BNPL is, how it works, and whether it's really the best choice for your financial situation.

here's a quick look at what we'll cover

|

|

what is buy now, pay later?

what is buy now, pay later?

BNPL is a short-term financing option that lets you make a purchase today and pay for it over time in installments. Companies like Klarna, Affirm, and Afterpay have simplified this process so you can shop now and pay later, often with just a few clicks. Some BNPL options are interest-free as long as you pay on time, making it an appealing option if you’re looking to avoid credit card interest or fees.

how do people use buy now, pay later?

how do people use buy now, pay later?

Here are steps to help you understand how to start using BNPL services and make the most of a shopping experience.

Step 1: Select a BNPL Service

Step 2: Shop Online or In-Store

Once you've picked your BNPL service, it's time to shop! Whether you're browsing online or hitting the stores, make sure the retailer supports your chosen BNPL option. Many retailers display BNPL logos on their payment pages or at checkout counters.

Psst... you can also learn which retailers support BNPL within the app. Here's a look at the featured retailers listed in the Klarna app.

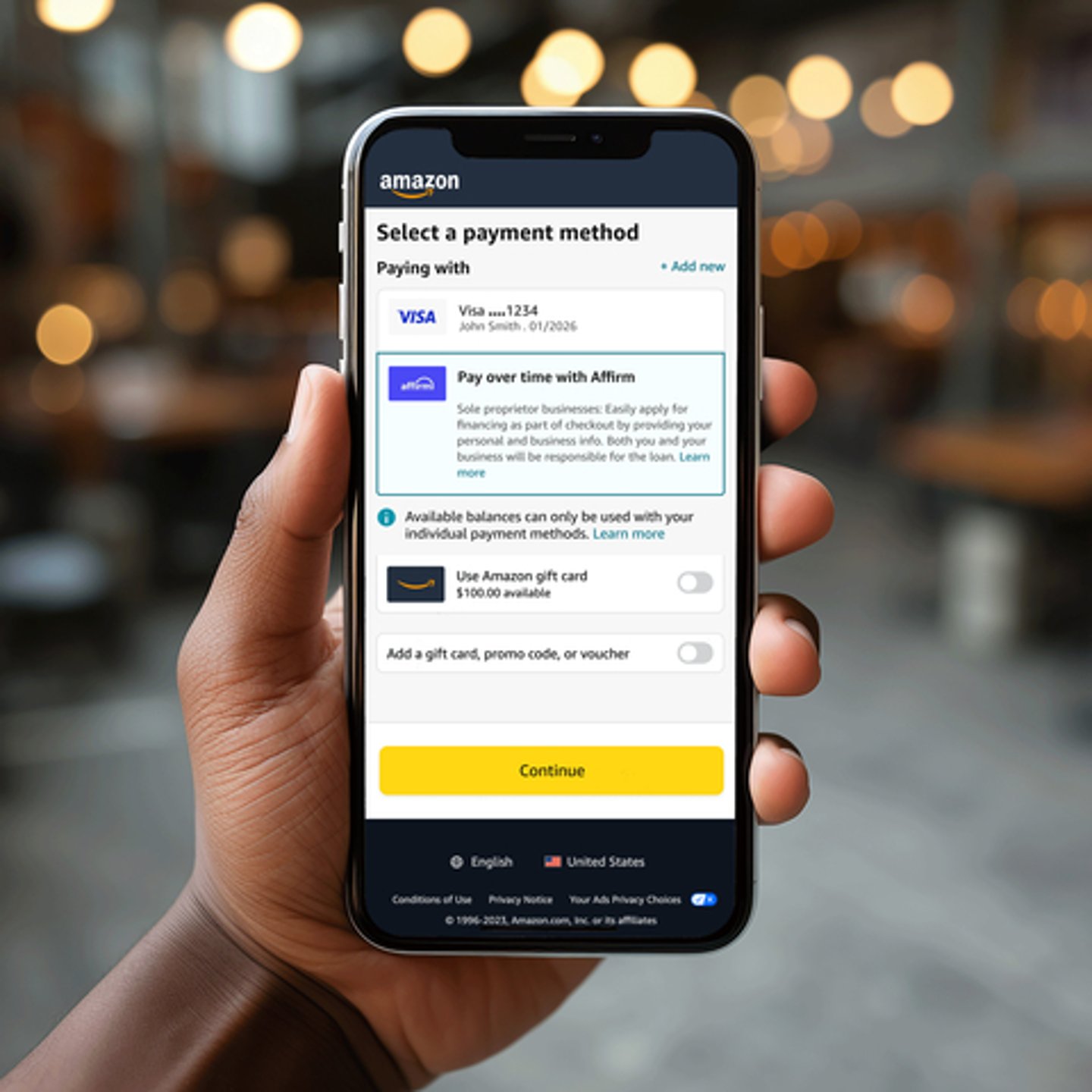

Step 3: Choose BNPL at Checkout

When you’re ready to make a purchase, select the BNPL option at checkout. This choice will appear alongside other payment methods like credit card or PayPal. Click on it to proceed with your BNPL plan.

Step 4: Set Up an Account

If it’s your first time using the service, you’ll need to set up an account. This usually involves providing some personal information and linking a payment method like a bank account or debit card.

Step 5: Understand the Payment Schedule

Take a moment to review the payment schedule. BNPL services typically divide your total purchase into equal installments. Make sure you know the due dates and amounts for each payment to avoid surprises.

Step 6: Make Payments on Time

Stay on top of your payment schedule! Set reminders or automatic payments to ensure you never miss a due date. Missing payments can lead to late fees and possibly affect your credit score, so it’s crucial to keep track.

A major draw of BNPL is its flexibility—whether it's buying a big-ticket item or covering smaller everyday costs like groceries or clothing.

A major draw of BNPL is its flexibility—whether it's buying a big-ticket item or covering smaller everyday costs like groceries or clothing.

The idea is to break up larger purchases into smaller, manageable payments over weeks or months, often without interest. This structure can help spread out expenses and make budgeting more manageable, especially for those looking to avoid putting purchases on credit cards.

pros and cons of buy now, pay later

pros and cons of buy now, pay later

pros

- Easy to Use: Quick approval process with minimal credit checks.

- Flexibility: Spread your payments over weeks or months, making budgeting a breeze.

- Interest-Free Payments: Pay on time, and you might avoid interest altogether.

- Budget-Friendly: Spreading out payments can make managing finances easier.

cons

- Temptation to Overspend: The ease of deferring payments may lead to impulse buying, adding up to more debt over time.

- Debt Accumulation: If you're not careful, you might take on more payment plans than you can comfortably handle.

- Fees and Penalties: Missed payments can lead to late fees, and some services might report these to credit bureaus, potentially impacting your credit score.

when is buy now, pay later a good option?

when is buy now, pay later a good option?

BNPL can be a helpful tool if you have a clear plan to repay and are confident you can meet all payment deadlines without disrupting your budget. It's particularly useful for planned or one-time expenses where spreading out the payments can ease financial strain—like replacing a broken appliance, buying a flight for a trip you’ve saved for, or covering large, necessary costs that you’ve anticipated.

Using BNPL for essential purchases, rather than impulse buys, can help you make the most of its benefits. If you know exactly how and when you'll be able to pay off your installments, BNPL can offer a convenient way to handle short-term expenses without dipping into savings or running up credit card debt.

It’s also a great option if you want to take advantage of deals and discounts that may not be available later, as long as the payments are manageable within your budget. The key is to use BNPL strategically to enhance your financial flexibility without falling into debt traps.

when should you avoid using buy now, pay later?

when should you avoid using buy now, pay later?

BNPL might not be the best choice if you tend to spend impulsively or are already tight on finances. Spreading payments on smaller items—like a $150 pair of shoes or a $300 gadget—can seem manageable, but they can add up quickly, leading to multiple payment plans that can become overwhelming. Without careful budgeting, it’s easy to fall into a cycle of debt.

Additionally, if you dislike the idea of owing money or keeping track of multiple payments, BNPL may not be a great fit. It’s important to use BNPL only for necessary purchases and to have a clear plan to pay off the installments on time.

QUICK TIP: If you're considering using BNPL, avoid using your credit card to pay off your BNPL loan—it's a recipe for unnecessary debt stress! |

is buy now, pay later better than credit cards?

is buy now, pay later better than credit cards?

It depends on your financial habits. BNPL can be a good alternative to credit cards if you're looking to avoid interest and fees, as long as you stick to the payment schedule. On the other hand, credit cards might offer perks like cashback rewards and more flexibility in how you repay. Consider how well you manage credit and your spending patterns before choosing.

does buy now, pay later affect your credit score?

does buy now, pay later affect your credit score?

BNPL services usually don't require a hard credit check, so applying won't initially impact your credit score. However, missed payments may be reported to credit bureaus, which can hurt your score over time. Make sure you're clear on the terms of your BNPL agreement and pay on time to avoid this.

if you're looking to improve your credit score, we have just the thing to help.

Psst... You may get approved for BNPL services if you have less-than-perfect credit. BNPL services often approve users since they might only perform soft credit checks or none at all. Still, use it wisely to avoid any debt pitfalls. |

is buy now, pay later your next step?

Now that you know the basics, it's time to decide if BNPL fits your lifestyle. It can help manage big purchases, especially if you’re balancing school, work, or tight budgets. But use it wisely—stick to a repayment plan and avoid overspending. When in doubt, keeping debt low is the safest bet.

If BNPL isn’t right for you, explore saving for larger purchases, budgeting, or credit cards with low interest rates. Finding what works best for your financial goals is key. Download our FREE Smart Budgeting Guide for help.

Need help navigating your financial goals?

At Skyla, we're here to help you every step of the way. Shoot us an email or give us a call at 704.375.0183, and let’s chat about how we can help you make the most of your money!

As Content Strategist behind the Learning & Guidance Center, Yanna loves showing just how doable finance can be. Whether it’s simple tips, step-by-step guides, or comparison charts, she’s passionate about helping readers take charge and reach financial freedom with confidence

more resources for your financial journey

Best Budgeting Tips for Special Occasions

Celebrate your next special occasion on a budget with these helpful tips. We've got advice for how you can save money on gifts, travel and more.

8 min. read

How to Build Credit Without Going Into Debt?

Questioning how to build credit without going into debt? There is more than one way to do it like identifying any errors on your credit report, and more...

9 min. read