Understanding GAP Insurance

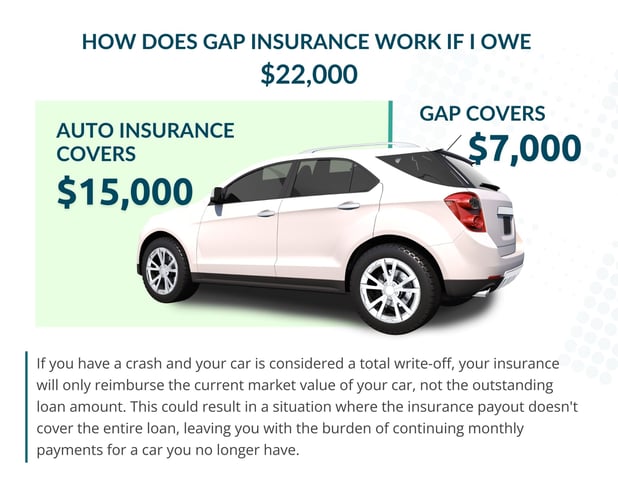

When you purchase a car, you might take out a loan to cover the cost. However, as soon as you hit the road, the value of your car starts to depreciate. Now, let's say your car gets stolen or is damaged beyond repair. You file a claim with your primary auto insurance provider, and they cover the car's current market value, which is the amount your car was worth right before the unfortunate incident.

But here's the catch - what if the market value of your car is less than what you still owe on your loan? This leaves you with a 'gap' that you'd have to pay out of pocket. That's where Guaranteed Asset Protection (GAP) steps in!

QUICK TIP: GAP insurance is the general term, but at Skyla, we offer this benefit as GAP Protection when you finance your auto loan. Check it out> |

what is gap insurance?

what is gap insurance?

Guaranteed Asset Protection (GAP) is essentially extra insurance from your lender to cover the difference between the actual cash value of your vehicle and the outstanding loan balance you owe in the event of an accident or theft. It comes into play when your regular auto insurance payout doesn't fully cover the remaining amount you owe on your car loan.

here's a quick look at what we'll cover

|

|

when do you use gap insurance?

Even if something unexpected happens to your car, with GAP, you won't be left grappling with a hefty car loan for a vehicle you can no longer use.

Here's a quick look at how much auto insurance would cover and what GAP insurance would provide if your vehicle were deemed a total loss and you still owed $25,000 on your auto loan.

what vehicles does skyla's GAP protection INCLUDE?

- Autos

- Light Trucks

- Motorcycles

- ATVs

- Power Sport Vehicles

- Small watercraft

- Larger Boats/RVs/Travel Trailers

- Commercial Vehicles

DEFINITION: A commercial vehicle is one used mainly for business. It's typically owned and insured by a company, may display the company's name, and could be listed in commercial vehicle guides. Even if owned by an individual, it can be considered commercial if it's primarily used for work. |

why would i need gap insurance?

why would i need gap insurance?

- High loan-to-value ratio (LTV): This means you borrowed a lot of money to buy your car, and you still owe a lot compared to what your car is currently worth.

- Long-term car loan: If you decide to pay off your car over a long time (like more than 4 years), you could end up owing more money than what your car is worth at some point. This is because cars lose value over time.

- Small down payment: If you only paid a little bit of money upfront (a small down payment), then you probably had to borrow more through your auto loan. Again, this could mean that at some point, you owe more than what your car is worth.

- Regularly driving your car for long distances: If you often drive far distances, your car's value may depreciate faster due to the high mileage. This could lead to a situation where you owe more on your loan than what the car is worth.

- Selecting a vehicle with high mileage: If you bought a car that already had high mileage, its value will likely decrease faster than your loan balance. This increases the chance of owing more on your loan than the car's value.

In these cases, GAP insurance can be really helpful. If your car gets stolen or is so damaged it can't be fixed, your regular car insurance will only pay you what the car was worth just before it got stolen or damaged. But if you owe more on your loan than that, you'd have to pay the difference yourself. GAP insurance covers this 'gap' and pays that difference for you. So it can save you from having to pay a lot of money out of pocket.

does it cost to have gap insurance?

does it cost to have gap insurance?

Yes, there is a cost associated with GAP insurance. However, at Skyla, this cost can be conveniently financed into your loan or paid out of pocket.

QUICK TIP: Our lending specialists are always ready to help you understand why your specific loan might benefit from GAP protection. |

pros and cons to gap insurance?

Pros

- Financial Protection: GAP insurance is designed to protect you from significant financial loss. If your vehicle is stolen or totaled, GAP insurance covers the difference between the actual cash value of the car and the remaining balance on your loan or lease.

- Peace of Mind: Knowing you won't be left with a large bill for a car you can no longer use can provide substantial peace of mind, particularly if you're buying a more expensive vehicle or have a high loan amount.

- Beneficial for Long-Term Loans: Vehicles depreciate quickly. If you've opted for a long-term loan (4 years or more), you could find yourself "upside-down" on your loan fairly quickly, meaning you owe more on the loan than the car is worth. GAP insurance can be particularly beneficial in these situations.

- Useful for New Cars: New cars depreciate the fastest in the first few years. If your new car is stolen or totaled during this period, the payout from your regular auto insurance might not cover the full amount you owe on the car.

- You get $1,000 Credit Towards Your Next Loan: If you finance your next vehicle with Skyla within 90-days of filing a claim, GAP will pay $1,000 towards your new loan!

Cons

- Additional Cost: GAP insurance adds an extra cost to the purchase of your vehicle. You'll need to consider whether the added expense is worth the potential benefits.

- Not Necessary for Everyone: If you've made a large down payment or your car loan is short term (3 years or less), you're less likely to be upside-down on your loan. Therefore, GAP insurance may not be necessary.

- Limited Coverage: GAP insurance only covers the difference between the actual cash value of the vehicle and the remaining balance on your loan or lease. It does not cover any deductible on your primary auto insurance, nor does it cover other expenses like rental cars.

- Redundancy with New Car Replacement Coverage: Some auto insurance policies offer new car replacement coverage, which replaces a totaled new car, not with the depreciated value, but with a new model. If you have this coverage, GAP insurance may be redundant.

are there common misconceptions about gap insurance?

- GAP insurance is a replacement for standard auto insurance: This is a common misconception and not the case; GAP insurance is an additional coverage that works in tandem with your auto insurance.

- GAP insurance covers any missed car payments due to financial hardship, unemployment, or medical issues: Nope! GAP insurance only covers the difference between the value of your car and the amount you owe on your car loan in the event of total loss or theft.

Quick Rules to remember for GAP Insurance

- GAP protects the loan, not the vehicle: GAP insurance is designed to cover the amount you owe on your loan if your vehicle is totaled or stolen, not the vehicle itself.

- GAP can be purchased at any time: You can decide to buy GAP insurance whenever you want, it's not limited to when you first get your loan.

- GAP is fully refundable within 60 days of loan closing, non-refundable after 60 days: If you decide you don't want the GAP insurance, you can get a full refund within 60 days of closing your loan. After that period, you cannot get a refund.

- GAP does not pay for additional funds, or late/skip fees added to loan balance: Any extra charges like late fees or skipped payment penalties added to your loan won't be covered by GAP insurance.

- GAP does not pay for interest charged after date of loss: If your vehicle is totaled or stolen, GAP insurance won't cover any interest that accrues on your loan after that date.

ready for gap insurance?

Feeling like it's time to add GAP to your financial utility belt? Here's what you can do next:

- Reach out to our team at Skyla. Our lending specialists are ready to answer all your questions and guide you through the process of securing GAP Protection.

- Take advantage of the Skyla GAP Plus benefit. If you finance your next vehicle with Skyla within 90 days of your GAP claim being paid, we'll give you $1,000 towards your new vehicle.

Our Customer Service Representatives are here for you and ready to assist! You can get in touch with us here or call us at 704.375.0183.

As Content Strategist behind the Learning & Guidance Center, Yanna loves showing just how doable finance can be. Whether it’s simple tips, step-by-step guides, or comparison charts, she’s passionate about helping readers take charge and reach financial freedom with confidence

more resources to get you ready to roll

When Should I Auto Refinance?

Learn the best time and worst times to refinance your auto loan. Learn how credit score, interest rates, and loan terms affect your decision.

7 min. read

What Happens After I Pay Off My Auto Loan?

Don't know what happens after you make you last payment on your auto loan? Here's that process of getting your title and learn how to manage your funds.

10 min. read

see if you should pre-qualify

see if you should pre-qualify

Want to know the pros and cons of getting pre-qualified for an auto loan? Here's how prequalifying can benefit you before officially applying for an auto loan and more.

understanding gap insurance

understanding gap insurance

Learn how GAP insurance can protect you from paying out of pocket if your car is totaled or stolen. Find out if it's the right choice to safeguard your finances.

determine your auto loan options

determine your auto loan options

Identify auto loan types, how auto loans work, where to shop for auto loans and more.