How to Read and Understand Credit Card Statements

Have you ever received a credit card statement and weren’t quite sure what you were looking at? I get it!

Have you ever received a credit card statement and weren’t quite sure what you were looking at? I get it!

There are typically 2 balances listed (statement balance and the current balance), you’re given a ton of dollar amounts and due dates, and your interest amount always seems to fluctuate… These are just a few essential things you should immediately review when receiving your credit card statement but it's easy to skip past these crucial pieces…

Reading and understanding your credit card statement is essential when managing your credit card responsibly. So here's a breakdown of each section using Skyla's credit card statement. This will help you know what each section means when it's time to responsibly handle your credit card account.

IF YOU WANT TO JUMP TO ANY SECTION, HERE’S WHAT WE’LL BE COVERING:

|

|

so...what is a credit card statement?

Your credit card statement is a look at how you've used your credit card during a billing period. The statement will include recent transactions, interest rate and amount, and any other fees or charges that may apply to your credit card during the billing period.

You should receive your credit card statement at the end of every billing cycle either by mail or electronically depending on your lender.

Psst...If you're a member of Skyla and want to receive your credit card statements electronically, log in to Online Banking and hit the Statements Tab to get started.

what's included and why is it important?

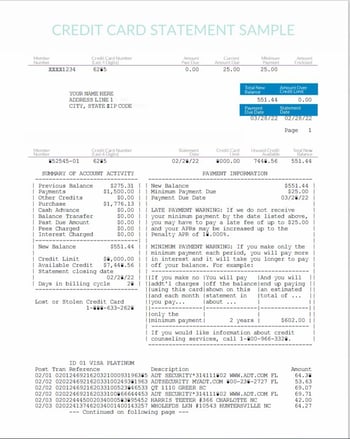

Not all credit card statements look the same, but they should include the same kind of info. Using Skyla’s sample credit card statement, let's run through what that includes:

Account information

- Your name: The name on your statement is the legal name you used to open your credit card. (Always make sure this is correct!)

- Your mailing address: Make sure your address is correct- which it should be if it's mailed to you and you've received it but it's always good to check.

- Account number or member number: On the off chance the account number isn’t accurate, you’ll want to call your lender immediately to get it fixed.

- Credit card number: Check the card number that is listed. If you have more than one credit card, this will help you when tracking your expenses.

- Billing cycle or statement cycle: This is the period between your last credit card statement closed and the next credit card statement. Any transactions conducted during this period will be enclosed in the credit card statement.

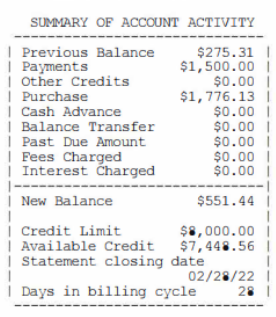

Summary of account activity or Account Summary

This is a high-level overview of what’s changed on your credit card since your last statement.

- Previous Balance: This is the balance from your last billing cycle.

- Payments: The payments you made towards your balance during the last billing cycle.

- Other Credits: If you received any reimbursements or credits on your card, this is where it’d be listed.

- Purchase: New purchases made on your credit card.

- Cash Advance: If you withdrew money from your credit card in cash, this is a cash advance. This area will list the amount you've withdrawn.

- Balance Transfer: Any amount of money you've transferred from a different credit card to the current card in question.

- Past Due Amount: The unpaid balance from your previous billing cycle.

- Fees Charged: Any fees that were charged on the card will be listed here. This includes late fees, annual fees, and overdrawn fees.

- Interest Charged: A quick view of the Annual Percentage Rate (APR) with the daily or monthly interest charged on your credit card during the billing period.

- New Balance: This is the unpaid or new balance on your credit card.

- Credit Limit: This shows the total loan limit on your credit card.

- Available Credit: Any amount of credit you haven't used will be listed here.

- Statement Closing Date: As reflected in your billing cycles section, this shows the date your cycle statement closed.

- Days in the Billing Cycle: This shares the number of days in your billing cycle.

QUICK TIP: Make sure you pay attention to this section when reviewing your statement. If you don’t have time to read your entire statement, this section will give you a quick summary of what you need to know to manage your account and make your next payment. |

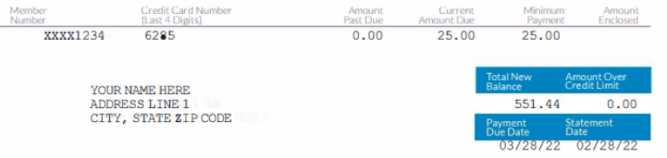

Payment information

This is the next section your eyes should move to so when you’re ready to make your payment, you’ll know how much you need to pay so you’re not late when your credit card bill is due. This section includes your card’s total new balance, minimum payment due, and payment due date.

Psst...If you plan to submit your payment by mail, make sure it’s received by end of the business day at 5 pm. If your due date falls on a holiday, businesses typically consider it on time if they receive the payment the next business day by 5 pm. If you want to avoid your payment from arriving late via postal mail, consider making your payment online.

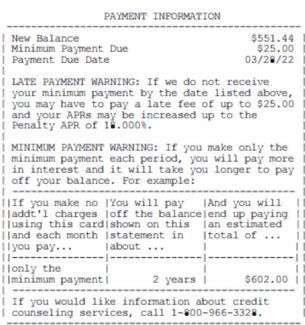

Late payment warning

Like Skyla’s credit card statement, many issuers disclose the late payment warning within the payment information area. This simply tells you what happens if you're late paying your bill. There are always consequences if you miss making your payment on time, and those consequences will be spelled out here in addition to fees and the penalty Annual Percentage Rate (APR).

Like Skyla’s credit card statement, many issuers disclose the late payment warning within the payment information area. This simply tells you what happens if you're late paying your bill. There are always consequences if you miss making your payment on time, and those consequences will be spelled out here in addition to fees and the penalty Annual Percentage Rate (APR).

Psst... Anytime you're late making a payment, expect your APR to increase and to get hit penalty fees.

QUICK TIP: Make sure you don't miss a payment. Your credit score will be impacted if you do. Lenders report credit card activity to the credit bureaus, and missing a credit card payment can significantly drop your score. Check out this article about What’s The Most Important Thing to Know about Credit Scores to learn more about how to avoid that. |

Minimum payment warning

Many issuers disclose the minimum payment warning within the payment information area. If you were only able to make the minimum payment on your credit card each month, this section would show how long it would take to repay the balance and estimate how much you may be paying, including interest. Depending on the credit card issuer, they may include a handy minimum payment calculator in their statement which will also outline the length to pay off a current balance if you were to only make the minimum payment required.

Psst… check out this Credit Card Payment Calculator if this info isn’t available:

Notice of changes to your interest rate

If there were any changes to your interest rate, expect the changes to be listed here. This is where your credit card issuer will disclose if you went over your credit card limit or made a late payment. Your credit card company will disclose if your interest rate changed at least 45 days before officially changing.

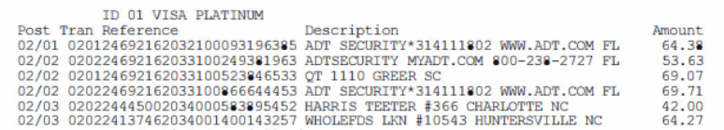

Transactions

As you look further at your statement, you'll see a list of all your transactions describing your credit card activity during the billing period. Pay close attention to your transactions here in case there's unauthorized activity happening with your account. You'll know to report it to your lender right away.

Fees and interest charges

Next, check the fees and interest charges listed on your statement. This section should be separated from the others, so you know what you're being charged. Let's say you were charged for making a cash advance and a different interest rate, this would be listed here.

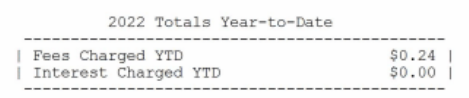

Year-to-date total

This gives you a quick view of all the fees and interest you've paid for the current year.

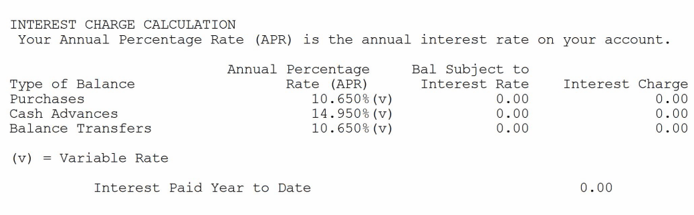

Interest charge calculation

If you need help understanding the interest charged on your credit card each year, check this section. It gives a summary of all the interest rates on the different types of transactions on your statement. Here's a sample look.

how to become a responsible credit card owner

Reading and understanding your credit card statement is a huge factor in your role of being a responsible credit card owner. As soon as you receive your credit card statement, take a moment to read and review your charges for the billing period. On your statement, make sure you always:

- Look for any fees that you may be charged.

- Notice your minimum payment

- Peep the dates, including when your payment is due and your billing period.

- Check the interest changes or any important notices from the bank or credit card issuer.

- If you notice any charges listed in your transaction history, report them right away.

|

here's what's next:

Now that we've gone through the important parts of a credit card statement, it's time to do some credit card tracking. You can track your credit card expenses using your statement or you can track your credit card expenses in other ways like receipts, credit card tracking apps, and more. Here's an article sharing those details:

not a credit cardholder yet?

If you're not a credit card holder yet and want to know what having a credit card entails and know what to watch out for when you do have a credit card, here's an article about What You Should Know Before Getting a Credit Card:

As the Content Specialist and author of the Learning & Guidance Center, Yanna enjoys motivating others by uncovering all that's possible in the world of finance. From financial tips and tricks to ultimate guides and comparison charts, she is obsessed with finding ways to help readers excel in their journey towards financial freedom.

more resources for your credit card journey

How Should I Track My Credit Card Spending?

Tracking credit card expenses can be tricky when ensuring everything adds up correctly. Here’s how to track and stay on track with your expenses, so you don’t miss a thing when repaying your lender.

11 min. read

What You Should Know Before Getting a Credit Card

Don’t know what to expect when getting a credit card? Here’s what you need so you can properly prepare and enjoy your credit card today.

17 min. read

Avoid Common Credit Card Mistakes

Avoid Common Credit Card Mistakes

Check out the mistakes many make and how to avoid them at all costs.

Read and Analyze Your Credit Card Statements

Read and Analyze Your Credit Card Statements

Struggling to understand your credit card statement? Here’s a breakdown of what it entails.

track your credit card spending

track your credit card spending

Here's how to effectively track & stay on top of your expenses to avoid missing payments and more.

.png)