What are your initial thoughts when you hear or see the words "no payment needed" for an auto loan...?

Is it a relief to hear that you're not forced to come out of pocket to pay a percentage of an auto loan that's already thousands of dollars? Or do you think it's a trap for you to eventually default on your loan because you failed to put 20% down?

When lenders offer a zero-down payment on an auto loan, it's not a trap and can help you when you truly don't have the cash on hand.

Psst...If you're thinking of doing no money down on an auto loan, first calculate what your monthly payments would be so you're prepared. |

Down payments - particularly hefty ones on auto loans - can be terrific when your credit isn’t in the best shape and you don’t have time to improve your credit score. Putting money down for a car loan can limit the amount of interest you’ll pay during the life of the loan, but this varies based on the amount and the lender you choose. Ultimately, consider a down payment on an auto loan if:

-

-

- You have a low credit score

- You want to save money in the long-term

- You want to increase your chances of getting your auto loan approved

-

QUICK TIP: According to Credit Karma and Experian, you should aim for 20% down, especially for new vehicles. Generally, your payment should be big enough that it produces an affordable monthly price and interest rate. |

should you consider a down payment on your auto loan?

Short answer? Yes! The more money you put down, the less money you'll have to pay back over the life of the loan, saving you money in the long run.

In this article, I'll dive deeper and share some tips that we give our members at Skyla when making a decision on down payments. Ready to get the facts?

understanding auto loan down payments

what's a down payment?

A down payment is a percentage of the total cost of the loan made upfront and put towards the purchase price. For example, if you're looking at a car that's going to cost you $35,000, but you make a down payment of $7,000, you'll only need to apply for a loan for $28,000.

what's acceptable as a down payment?

Not all lenders require you to make a down payment, but if you do, cash, debit card, money order, or check are all acceptable forms of down payment. If you're financing at the dealership, they may also accept credit cards.

Another form of a down payment is the value of a trade-in. If you’re trading in your current vehicle for another, the dealership can calculate the value of your current car and deduct that amount from the total cost you owe.

Let's say you owe $12,000 on your current auto loan for a vehicle the dealership says is worth $18,000. You can trade-in your current vehicle, pay off that existing loan of $12,000, and still use the extra cash as a down payment of $6,000 towards the new loan. |

benefits of putting a down payment on an auto loan

Placing a down payment on your auto loan provides many advantages. Depending on your lender, a down payment may not be required, but it's preferred because you're making a personal investment on a loan. Lenders call this "skin in the game."

4 main benefits of down payments:

-

- It increases your chances of loan approval: If you have a low credit score, a down payment may help with approval because it shows lenders that you're committed to paying off the loan. Also, the more money you put towards a down payment, the more serious the lender knows you are about keeping the vehicle without getting into an accident.

- It can limit overall interest: The more money you put down, the less money you need to borrow, meaning you'll finance less of the vehicle. This is just one way to combat paying interest when financing.

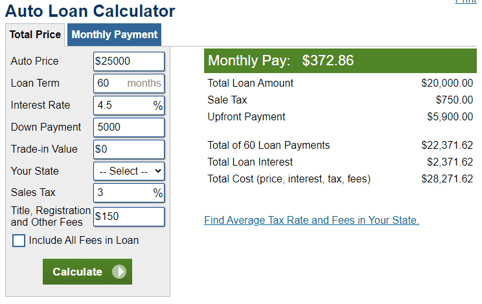

- Your monthly payments can be lower: Take this scenario as an example: You borrowed $25,000 with a 5-year loan term ). The interest rate is 4.5% and your down payment is $5,000. Your monthly payment would be $372.86 (or a little more if the loan included state tax, title, registration, and other fees). If you didn't put any money down towards the loan, your monthly payments would be as high as $466.08!

- It will offset depreciation: Depreciation is the value your vehicle loses over time. The most significant factors that affect your vehicle are its age and mileage. If you were in an accident and the vehicle is totaled then you could end up owing the lender more money and the vehicle would be worthless if you didn't put down a payment.

- It increases your chances of loan approval: If you have a low credit score, a down payment may help with approval because it shows lenders that you're committed to paying off the loan. Also, the more money you put towards a down payment, the more serious the lender knows you are about keeping the vehicle without getting into an accident.

QUICK TIP: A sizeable down payment can be a disadvantage if not budgeted properly. Making a large down payment could cut into your savings and other expenses if you don’t budget. Make sure you have the funds to make a down payment and can ultimately afford the auto loan. Also, be sure to include extra costs when budgeting for an auto loan, like title fees, taxes, and insurance. |

what if i can't afford a down payment?

If you don't have the cash for a down payment, here are some other options available to you:

-

-

- Use the trade-in value of your vehicle: If you're looking to replace your current vehicle with a new one, you can trade it into the dealer and use that as a down payment towards your new wheels.

- Purchase GAP insurance: If your vehicle was totaled and your insurance company pays out what your vehicle is worth, then Guaranteed Asset Protection (GAP) can help cover the difference between what you owe and how much your vehicle is actually worth.

- Get a cosigner for the loan: With a cosigner, you'll have someone who can help you pay off the loan. Typically, your cosigner will have better credit which will help to get you a lower interest rate.

- Buy a cheaper vehicle: With a cheaper vehicle, you won't have to borrow as much money, which means your monthly payments could be a smaller amount of money.

- Budget for the future: If you can't afford a down payment and can wait a little to buy, it may be best to go back to the drawing board and create a budget to help you save for one in the future.

-

ready to calculate?

Want to know if you can afford an auto loan with or without a down payment? Feel free to use this loan payment calculator to input your desired loan amount and get an idea of what your payments would be. Or you can try the auto loan calculator on Calculator.net, trusted by financial experts when receiving quick calculations on math, health, finance, and more.

Auto Loan Calculator

On Calculator.net, you can calculate your auto loan monthly payments by inserting your desired loan amount, down payment amount, loan term, sales tax, title, registration, and other fees. Once it's all inserted, simply click "Calculate" and the auto loan calculator allows you to see your prospective monthly payments with the loan principal and interest you'll be making on the loan.

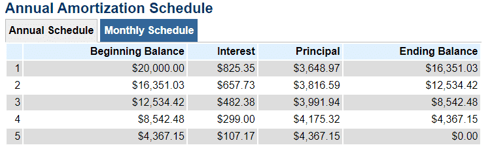

annual amortization schedule

Under the auto loan calculator, you'll also see an annual amortization schedule, which is a table showing the regularly scheduled payments towards your loan. This is a breakdown that includes the monthly and annual view of your auto loan beginning balance, interest, principal, and ending balance.

having trouble determining how much you can afford?

If you think you can't afford a down payment on your auto loan due to other monthly expenses, check out The Basics of Building Your Budget. You'll get tips and tricks to creating a budget that'll help put more money back in your pockets plus a free budgeting template!

it's time to consider a down payment on your next auto loan

Remember, an auto loan down payment helps you save money and increase your chances of paying less interest on your auto loan. Feel free to use the auto loan calculator on Calculator.net to see how much your down payment can affect your total monthly payments.

ready to roll?

Considering financing a vehicle through Skyla? Down payments are not required but encouraged!

As Content Strategist behind the Learning & Guidance Center, Yanna loves showing just how doable finance can be. Whether it’s simple tips, step-by-step guides, or comparison charts, she’s passionate about helping readers take charge and reach financial freedom with confidence

more resources to get you ready to roll

A Comparison of Auto Loan Options

Need an honest comparison between the different auto loan options for your perfect car? Here you’ll be able to identify auto loan types, how auto loans work, where to shop for auto loans and more.

13 min. read

What Are the Costs That Come With an Auto Loan?

In your journey to buying a car with an auto loan, you should know all of the expenses a car comes with. Here's what you'll need to be prepared for.

12 min. read

figure out what credit score is needed

figure out what credit score is needed

Find out the score you need, how your credit score is calculated, and more.

budget for an auto loan

budget for an auto loan

Searching for a new auto loan but don’t know your options when budgeting for one? Here's what'll help you determine if monthly payments or making a full payment up-front is the best way to go.

determine if you need to do a down payment

determine if you need to do a down payment

Want to know the pros and cons of getting pre-qualified for an auto loan? Here's how prequalifying can benefit you before officially applying for an auto loan and more.