What Is a Rewards Credit Card?

Imagine every swipe of your card bringing you one step closer to that dream vacation or the latest kitchen gadget you've been coveting. Intriguing, right? Well, welcome to the dazzling world of reward credit cards!

Did you know according the the latest Lending Tree survey that a whopping 87% of credit cardholders have at least one card that lets them earn rewards? Yes, you heard it right! So, if you're not part of this statistic yet, it's high time you join the party! |

But hang on! How do these magical pieces of plastic work? Why do they seem too good to be true? Get ready, folks, because we're about to take a ride into the exciting world of rewards credit cards.

here's what we'll cover

|

|

what is a rewards credit card?

what is a rewards credit card?

A rewards credit card, simply put, is a type of credit card that offers incentives or perks to cardholders for using it to make purchases. These rewards can come in various forms, such as cashback, points that can be redeemed for goods or services, or airline miles that can be used toward travel. The more you use your rewards credit card for purchases, the more rewards you earn. It's like getting a little bonus every time you swipe or tap your card.

Sounds cool right?

how do rewards credit cards work?

how do rewards credit cards work?

They work in a surprisingly simple way. Think of it as a 'thank you' from the credit card company for using their card. Every time you swipe, tap, or input your credit card details for a purchase, you're earning a little something back. The company tallies up your eligible purchases and gives you points or cash back based on the amount you've spent.

For example, if you have a credit card that offers 2% cash back and you spend $100, you'd earn $2 back. Now, that might not sound like much at first, but trust me, it adds up over time! Especially if you’re using your credit card for everyday purchases like groceries, gas, or dining out.

QUICK TIP: Keep in mind as you learn about rewards credit cards, it's like any credit card, the key is to pay your balance in full each month. Because if you're carrying a balance and getting charged interest, it could outweigh the benefits of the rewards. So, spend wisely, pay off your balance, and enjoy the perks |

credit cards vs. rewards credit cards

credit cards vs. rewards credit cards

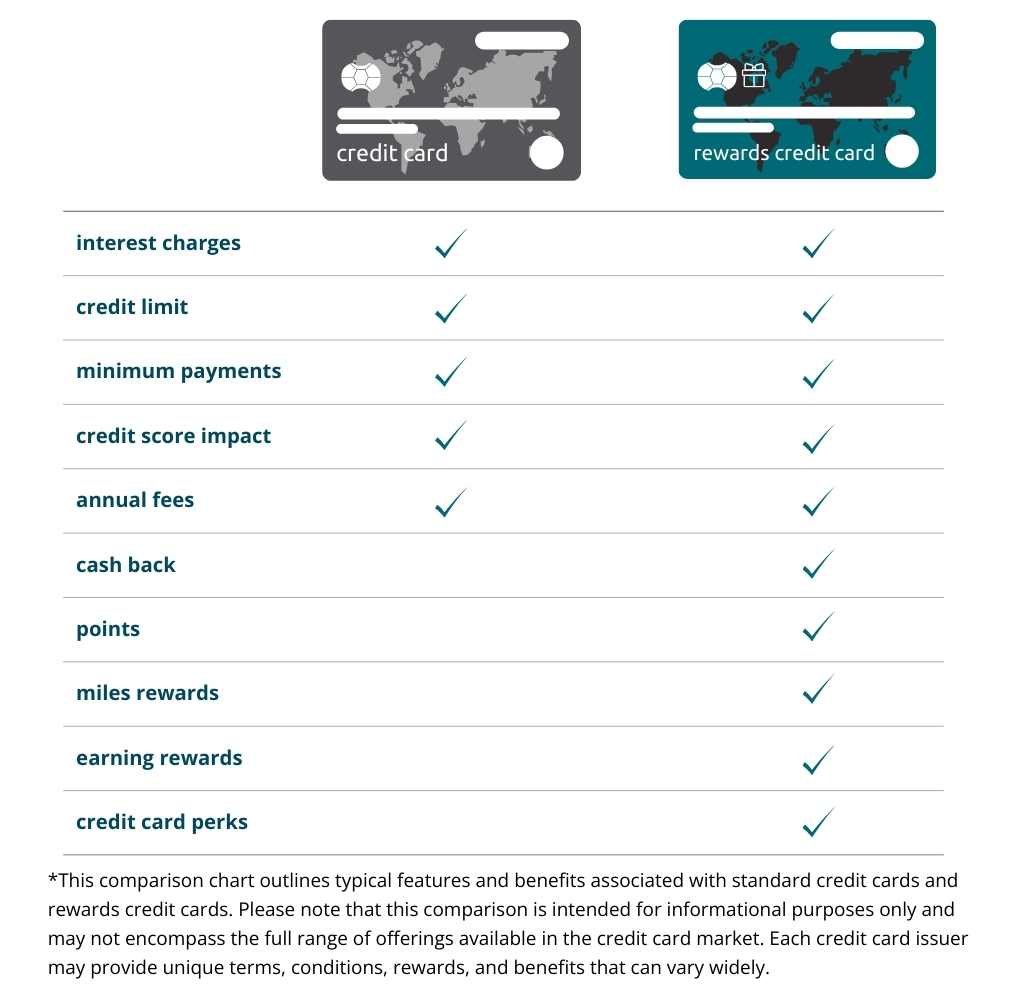

The primary distinction between a standard credit card and a rewards credit card lies in the benefits they provide. Here's a detailed comparison:

credit cards

INTEREST CHARGES

It's like a library book; if you don't return it by the due date, you get charged a fine. Except, with credit cards, the fine is interest on your remaining balance, known as the Annual Percentage Rate (APR).

CREDIT LIMIT

Think of it as your credit card's spending power. It's the maximum amount you can borrow on the card, kind of like a personal loan from your bank that you can tap into whenever you need.

MINIMUM PAYMENTS

Imagine you're at a buffet. You've loaded up your plate, but you can't possibly finish it all. The minimum payment is like eating just enough so you don't get kicked out of the restaurant. But remember, the more you leave on your plate (or in this case, your balance), the more you'll have to deal with later.

CREDIT SCORE IMPACT

Your credit card is like a report card for your financial behavior. Pay your bills on time and keep your balance low, and you'll look like a star student. But miss a few payments, and your GPA—err, credit score—takes a hit.

ANNUAL FEES

Just like a gym membership, many credit cards come with annual fees. The trick is to make sure the benefits you get from the card (like points or cash back) outweigh the cost of the fee.

reward credit cards

CASH BACK

Picture getting a small refund on everything you buy. That's cash back. Spend $100 on groceries, get $2 back. It's like having a tiny coupon for every single purchase!

POINTS

Points are like the gold stars you used to get in school. Every dollar you spend earns you points, which you can trade in for cool stuff like travel, gift cards, or even a credit towards your bill.

MILES REWARDS

Imagine if every time you used your card, you got closer to your dream vacation. That's miles rewards! These can be traded in for flights, hotel stays, and more.

SPECIFIC RETAIL REWARDS

Some cards are like a VIP pass to your favorite store, offering exclusive discounts or freebies. It's like being part of an exclusive club, just for using your card!

EARNING REWARDS

The more you spend, the more you earn. Different cards have different earning rates, kind of like different jobs pay different salaries. Some even offer bonus points for spending in certain categories, like dining out or booking travel.

CREDIT CARD PERKS

On top of all these rewards, some cards throw in extra perks. Think of them like the cherry on top of your rewards sundae, offering benefits like travel insurance, access to fancy airport lounges, or protection on your purchases.

what are the pros and cons of having a rewards credit card?

Pros of Having a Rewards Credit Card:

- Sweet Rewards: Rewards cards offer all kinds of treats, like cash back, points, or miles, every time you swipe that magical plastic.

- Cashback Confidence: Imagine getting a little cashback in your wallet just for buying stuff you were going to buy anyway. It's like a secret payday!

- Travel Dreams: If you're a jet-setter, travel rewards cards can whisk you away with points and miles for flights, hotels, and adventures. Hello, dream vacation!

- Discount Dance: Some cards give you discounts, exclusive access, or even freebies at your favorite stores or restaurants. Retail therapy, anyone?

- Credit Score Boost: Responsibly using your rewards card can actually help boost your credit score. It's like a win-win for your wallet and your credit report.

- Safety Net: Credit cards offer a layer of protection against fraud, and you won't lose your own money if your card is stolen or misused

cons of Having a Rewards Credit Card:

- Interest Costs: As I've mentioned before - make sure you pay off your balance. If you don't pay your balance in full each month, the interest can pile up faster than a stack of pancakes at brunch. Ouch!

- Annual Fees: Some rewards cards charge annual fees, and if the rewards don't outweigh the fee, it's like paying for a party you're not invited to.

- Temptation Trouble: It's easy to get carried away with spending to earn more rewards, and that can lead to debt if you're not careful.

- Credit Score Slip: If you miss payments or carry high balances, your credit score can take a nosedive. Keep that credit score unicorn sparkling!

- Complexity Conundrum: Rewards programs can be as confusing as trying to solve a Rubik's Cube blindfolded. Knowing the rules and redemption options is a must.

- Rising Rates: Interest rates on rewards cards can be higher than those on non-rewards cards. Don't let the glitter of rewards blind you to high APRs

To help avoid some of these disadvantages of having a rewards credit card - here are some handy tips that can make a difference in using your rewards credit card responsibly.

QUICK TIP: Still on the fence about credit cards? Here’s what you should know before getting a credit card so you can properly prepare and enjoy your credit card today. |

what's next?

Now that you know the rewards credit cards basics - it's high time you learn how to choose one.

how do i choose a rewards credit card?

Achieving credit card reward success isn't difficult, but there are important things you should be aware of. Rest assured, you're already heading in the right direction to make the most of your rewards and enjoy the perks of a rewards credit card. Given the multitude of options available, it's crucial to identify the best choice that suits your needs.

As the Content Specialist and author of the Learning & Guidance Center, Yanna enjoys motivating others by uncovering all that's possible in the world of finance. From financial tips and tricks to ultimate guides and comparison charts, she is obsessed with finding ways to help readers excel in their journey towards financial freedom.

more resources for your credit card journey

What You Should Know Before Getting a Credit Card

Don’t know what to expect when getting a credit card? Here’s what you need so you can properly prepare and enjoy your credit card today.

15 min. read

How Many Credit Cards is Too Many?

It's no surprise to have more than one credit card in your wallet. But would multiple credit cards affect your credit score? Here's what you should know.

10 min. read

Rewards credit card basics

Rewards credit card basics

Learn about rewards credits and all it entails

Choosing a rewards credit card

Choosing a rewards credit card

Here's how to choose the best one for you.

master using credit cards effectively

master using credit cards effectively

Here are the best ways to use a credit card.

.png)